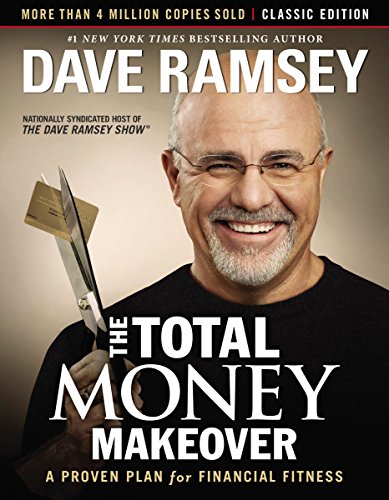

Reddit reviews The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness

Reddit reviews The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness

We found 7 Reddit comments about The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness. Here are the top ones, ranked by their Reddit score.

> BF - 24%

What are you doing to address this? Getting started on StrongLifts is a good thing, but nutrition and weight loss is the other half of the equation. Are you tracking calories? Do you know your TDEE and Macros? Figure that stuff out, and download MyFitnessPal and start tracking what you put in your mouth.

>While I no longer really desire my wife due to our history of problems both in and out of the bedroom

This is butthurt: "You don't want me, so now I feel like I don't want you." If your wife was giving you 100% in the bedroom, would you still feel the same way?

>I reintroduced kino to our relationship with fantastic results.

>She claims to hate it but I can clearly see she loves the renewed attention.

This is good. Keep working on this, especially in situations where it cannot possibly lead to sex at that moment. This helps it come off as truly genuine.

>that evening while we were lying in bed, she gave me an HJ under the covers while our daughter played around on the floor on the opposite side of the bed. This is so far outside the norm for my normally super up-tight wife that I thought she’d been possessed by a spirit or something. Two days prior to that we had sex for the first time this calendar year. So the results are starting to trickle in.

Awesome! This stuff works.

>10 minutes of visible work on my part has led to 5-10 hours of increased effort on her part each week.

Amazing how setting the example and leading makes such a difference, huh?

>We are constantly late to events because she’s dawdling around the house instead of taking our agenda more seriously. I’m going to have to start leaving her behind if she’s not in the car on time, or convincing her that appointments are 30 minutes earlier than previously stated in order to fool her into doing the right thing. I’m open to suggestions on this one.

My wife has been guilty of this as well, her attitude is "We're only a few minutes late, it's no big deal." Well it IS a big deal. I'm not a fan of the advice to leave without her - it may work, but I think it should only be used as a last resort when all else has failed. What has worked for me is to just tell her everything starts 15 minutes earlier than it really does, so we still get there "late" but on time.

How you decide to handle this depends on your specific dynamics: I have a good wife who is DTF whenever I want, works hard around the house, does all the cooking, is pretty submissive and follows my lead. I've chosen to give her a little grace in this area. This may not work in a different marriage - the wife might choose to take advantage of the husband. So YMMV, you'll have to play around with it and see what works.

>Family budget. I handle all of our finances but I have not been as disciplined as I could be. We’ve recently spent $15,000 on home improvements in order to rent out our basement as a guest suite, and within the next few weeks I anticipate we’ll be earning $1,000 per month from our tenant. We’re in a great area for finding renters and I already have multiple interested parties just from talking about it around the office, so I’m confident this will work. But in the meantime we’ve got a LOT of new debt, and I need to manage our money better so we can have a better emergency fund and less concern about monthly bills.

Sounds like a good investment that is going to pay off in 15 months, so that's not a bad thing. But if you don't have a full emergency fund, then you should cut your spending in other areas to achieve this. Dave Ramsey's The Total Money Makeover outlines a clear plan to achieve this. And honestly, anyone making $67 an hour should not be having money worries.

To get you started, I would suggest writing down all your essential monthly expenses. Those are the bills. They get paid first. Add them up, and add up your income for a month. The difference is really the only thing you have to discuss and get under control, since the bills are non-negotiable. Now if you have non-essential stuff like cable, etc. then you will have to decide what you can cut to make some breathing room in your financial situation. This should be a primary concern, since money problems contribute more stress to a marriage than almost anything else, and it is one of the top three reasons for divorce as well.

>Frame and outcome independence mindset are improving but are not there yet. I’ll keep reading, practicing, and improving.

For learning how to do things they should have taught you, I recommend the following:

Sorry to be harsh but it seams like you don't have an income problem but rather spending one. First, your car brings up red flags. Since you have 11k left on it, and it breaks down often and repairs are that much it leads me to believe that you drive a luxury car. Also your car is very inefficient, just to get you around GTA spending $200+/mo is something you can't afford. So what I'm saying right now, your car is your biggest preventer from your future financial freedom and you need to sell it like, yesterday! Yes I know you'll end up owing money on it, but it has to go! I cannot stress this enough.

Good news is that you can get out of this within 2-3 years, but it all depends on you! I went through the same situation, and guess what, I also made stupid decisions and also drove a car which basically ensured I stayed broke for manny years.

I'd recommend you do same things I did to get out of this:

It is a long road, it'll take you a few years, but it is VERY VERY doable. I've done it with similar parameters as you, and it feels great my friend. I'm now debt free, have a brand new house and I'm on the path to have it fully paid off within 8 years.

Good luck, and remember, your future self depends on your younger self!

Edit: I forgot to mention the book which really changed my mind and how I think about debt. It's by Dave Ramsay, look him up on Youtube, and buy his book, it's only $12 on digital. https://www.amazon.ca/Total-Money-Makeover-Classic-Financial-ebook/dp/B00DNBE8P6/ref=sr_1_2?gclid=Cj0KCQjwh6XmBRDRARIsAKNInDFqnTVZREntH0J2VwWYYj1adNKVIJ4WmK1iopd9iovz8Txo4bPADHoaAqB8EALw_wcB&hvadid=284818070799&hvdev=c&hvlocphy=9000724&hvnetw=g&hvpos=1t1&hvqmt=b&hvrand=15846815893330762740&hvtargid=kwd-287159694&hydadcr=16957_10238107&keywords=dave+ramsey+baby+steps&qid=1556707872&s=gateway&sr=8-2

Edit 2: Ok I just noticed that it's not a luxury car in your comments, but regardless you can't afford it right now.

https://www.amazon.com/Total-Money-Makeover-Classic-Financial-ebook/dp/B00DNBE8P6/ref=nodl_

Piracy is a form of stealing. Don’t think Dave would be OK with stealing.

If you really need the book, call in, and he might give it to you for free.

Dave has hard cover on his site for $16 and audiobook for $20 (price rounded up). Amazon sells kindle for $17.

There is no way to tell what your price range is based on the information you provide.

You can afford to spend up to a third of your monthly income on housing, regardless of whether you buy or rent. Now you can play around with a mortgage calculator to get a realistic price range. Let's say for the sake of argument that we're talking about a $100k house and you have enough cash to put down 20% and still have your cushion. Looks like you'd be spending a bit under $600/mo (always round up). Play with numbers and see what works. These days, assume a 4.5% interest rate.

BTW, your reserve is going to go away much more quickly than you think. I promise something more important than painting will come up that must be fixed!

As for the credit rating, you need to get both your numbers over about 680. If you are having trouble getting your financial house in order, the nice folks at /r/personalfinance are helpful if a little conservative. A lot of people really like this book for helping become debt free.

So now you should be ready to look at pretty pictures on the internet and maybe visit the occasional open house. More tips including a step-by-step for first time buyers in the FAQ. Good luck!

Pay off your loans, then build an emergency fund, and only then invest. If market declines (which it will one day), you'll be in a horrendous financial position, with debt bills that must be paid but funds that are losing their value.

Your loan interest rate may be 4.4% and the average market may be a higher rate than that, but those mathematical numbers do NOT take risk into account. If you account for that, mathematically, you're better off to take the guarantee return of paying off the loans sooner rather than later.

My advice: Get on a ridiculously aggressive plan to pay off the loans in 2-3 years. What you save on interest & risk will yield greater returns than taking a risk in the market.

Would highly recommend this book for help--it changed my life and will hopefully prevent you from making the same mistakes I did:

This book combined with both you’re husband’s full cooperation and being dedicated to financial discipline may be helpful.